Mother of five: tax reform will drive me out of the job market

The forthcoming tax reform will not only ruthlessly cut the income of royalty recipients, but will also hit the self-employed hard. Especially those who only earn a little. Mother of five, Ilze Mežniece, after consulting with the Ministry of Finance on the impact of the forthcoming tax reform on her income, realized that she would be punished for her desire to continue working. Sounds absurd? But how else to call the new procedure, which stipulates that the self-employed will have to pay taxes even if there is no income. Given the development of Covid-19, Ilze has a real chance to be without income for some months. In a conversation with Neatkarīgā, she reveals which she thinks is a greater danger - Covid-19 or the upcoming tax reform.

How do you manage to survive and teach five children, while living and farming in harmony with nature, without using agrochemicals, protecting the environment. This is not a very profitable venture.

It was our choice to live closer to nature, to grow our own food as much as possible. When buying products in the store, we don't know how they were grown, stored and transported. We can be sure of what is grown in our beds, that it is all high quality, clean and valuable. The same can be said for milk from our own cow.

It is for this reason that we moved from Riga to the countryside, moreover to deep countryside in Daugavpils region. The nearest village is 10 kilometers from our house. There are five children in the family, whose upbringing I consider to be the most important thing in my life. From my six-year-old Astra to my eighteen-year-old elder son Dominiks, they need me to be a real mother, not a running Fury who is never home. That's why I'm looking for a job to earn an income by working from home or working a job that doesn't require a long-term presence in person. I have found such a job. I run a folklore group in a small rural municipality, receiving 140 euros gross for it. Net income, of course, is even less. But it is a work of joy. I'm happy for everyone who comes or, to be more precise, came to rehearsals. The coronavirus has now introduced its corrections into public life as well.

But you can’t live long on joy alone. 140 euros a month is very, very little, after all.

My income figures will seem completely ridiculous to Rigans, but the rural population will understand quite well that there are no high-money jobs in the countryside. However, a low income can satisfy the basic requirements, as part of the typical expenditure of the city-dwellers does not exist. In order to provide comfort - housing, heat, water, a large part of food - a rural resident requires time and physical work, but not a large investment of money. In addition, I am also self-employed. I help with project writing and consulting. These incomes are not large either, they do not even reach the minimum wage, and they are irregular.

But don't think I'm complaining. It is our choice - to live in the countryside, to provide many things with our own hands, to raise children, not to seek profitable positions. Yes, the income is not high, but we manage.

As a self-employed person, your income is probably unpredictable.

Yes, it is so. One month I get 200 euros, another I get 300 euros and, of course, there are also empty months when there is no additional income next to my salary.

And for the next year, because of all this crazy situation, nothing is clear at all, right?

The question is which situation you consider to be crazier - is it the pandemic or the tax reform. It is starting to seem to me that tax reform will leave even deeper traces in the economy and more broken people than Covid-19.

Municipalities have already realized what awaits them next year. At the moment, they are hysterically looking for ways to reduce expenses and consolidate staff positions. Those currently working part-time in small rural municipalities are likely at risk of being let go. This will be done in order to be able to pay salaries and taxes for those who work full time. I will also no longer have a job in the municipality next year. I have already been told openly that, after the reform, I will be able to be hired at best for two months a year, for example, one month before Easter and one before Christmas.

This is not normal. The time people spend on folklore group is their free time. That's why we only meet once a week. It is not possible to organize rehearsals for only one month, but then every day and even for several hours. In addition, self-employed people want to present themselves, share skills, concerts and performances, and positive feelings are a reward for their work. One stressful performance a year is unable to provide satisfaction for people.

Leaders of these groups are often also self-employed, as this is not a full-time job. After the tax reform, it is clear that this sector will be cut off with a knife.

I also understand the municipalities, because they will have only as much money as they will. In addition, tax reform will increase the social burden. Many will be left without paid employment or will not be able to continue working as self-employed. All these problems will fall on the shoulders of the municipality.

However, the Ministry of Finance has estimated that 62 thousand of the current alternative tax users will find paid employment.

The largest employer in the county is the municipality, school and large farmers. The municipality is only able to employ a certain number of people, and even less after tax changes. I think no one has any illusions about teachers' salaries and work in the countryside. Farmers, on the other hand, mostly need specialists who are able to work with agricultural machinery - tractors, combines, etc. So there is no great prospect of paid work on our part.

If the planned tax changes really come into force, I do not know where they will end. I also have a hard time thinking about what to do next. Namely, after the currently planned tax reform, it turns out that a self-employed person with a low income, such as me, will have to pay 50 euros in social tax every month, regardless of whether they have had an income or not. Seeing the tax reform being implemented, which will leave people with much less money, worries me that my self-employed income could fall. In turn, I will have become extremely disadvantageous for the municipality, because my employer will have to pay 3.14 times more in taxes for me!

The state is going to drive me out of the job market with these financial repressions. What is left for me and others like me in this situation? Not working at all, moving to the shadow economy, registering an economic activity in a neighboring country? None of these options appeal to me, and some are entirely unacceptable. However, I assume that there will be people who, depending on the situation, will choose one of them.

The state's desire to deprive low-income earners of the very little that we get is painful and incomprehensible.

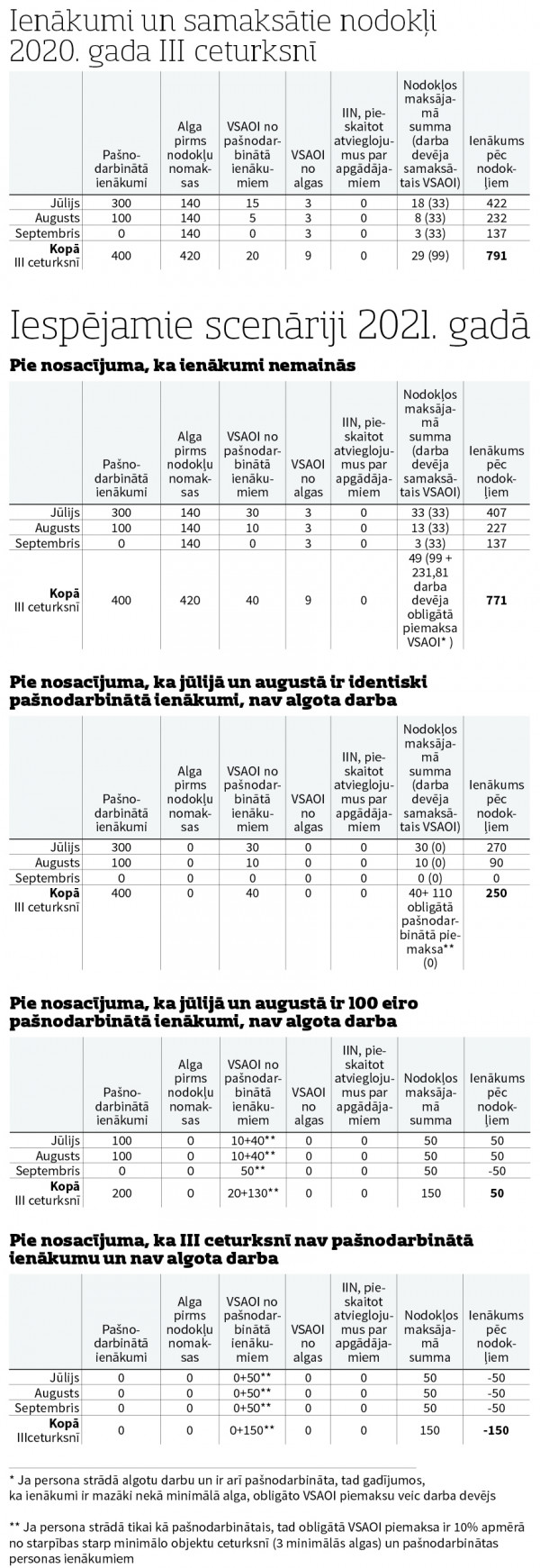

I’m looking at your estimates of how your income will change if this absurd tax reform really comes into force. Calculations show that you lose in any scenario. Even if you manage to keep your paid job. But for the months in which you do not earn anything, you will still have to pay extra to the state.

Yes, that’s how it is, and the Ministry of Finance approved it. The misfortune at the moment is that, in fact, there will no longer be any tax option suitable for those with low and irregular incomes. The tax options for micro-enterprises and for royalties will be abolished in the future, while the self-employed will be included in the general tax scheme.

I am being severely punished for choosing rural life, away from civilization, for wanting to give my children the opportunity to grow up in a clean environment, for providing many of the things we need for life with our own work, for being useful to others and, above all, for being independent.