During Covid-19, the state budget is filled by fines

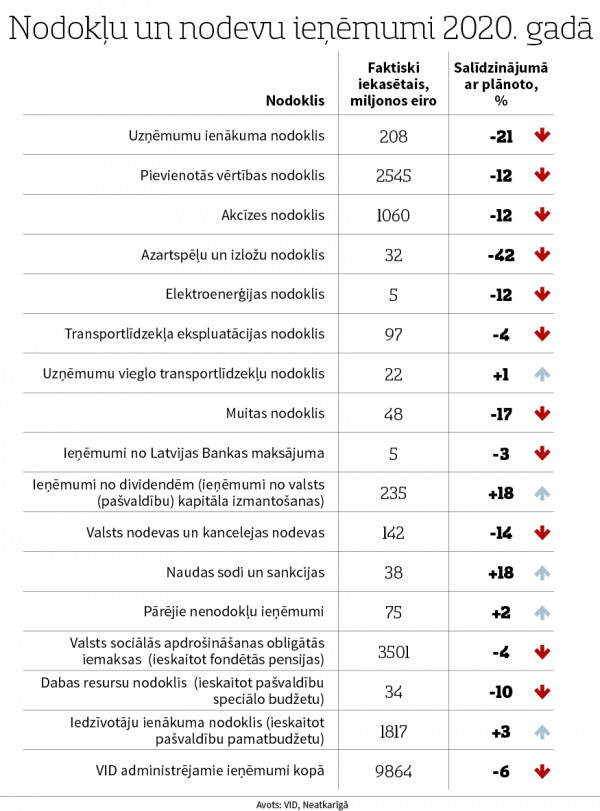

In 2020, the state collected less than planned in value-added tax, excise duty and several other taxes. On the other hand, the revenue from fines and sanctions was met and exceeded last year - 38 million euros were collected (18% more than planned), and this is the largest amount of fines ever collected in the state budget.

The total budget revenue administered by the State Revenue Service (SRS) in 2020 was 9.86 billion euros, which is more than half a billion (640 million euros) less than planned. The State Revenue Service explains this with the measures introduced last year to limit the spread of Covid-19.

Last year, tax revenues started to lag behind the plan, starting in March, when the state of emergency was introduced. The non-fulfillment of the revenue plan was most significantly affected by the low revenues from value-added tax and mandatory state social insurance contributions, as well as excise tax.

"Although the state of emergency was lifted, some restrictions were maintained, and the re-introduced state of emergency from 9 November 2020 continues to affect the economic activity of taxpayers this year as well," estimates the SRS.

Value-added tax revenues lagged behind the most for both the actual amount for 2019 and the amount planned for 2020. In 2020, the state collected a total of 2.55 billion euros in value-added tax (VAT), which is 104 million euros less than in 2019. SRS data show that VAT revenues decreased the most in the real estate, accommodation and catering services sector. The overall situation could not be offset even by the increase from July to November. In addition, compared to 2019, refunds from the value-added tax increased (the largest refunds were in the construction sector).

In 2020, the state received 1.06 billion euros in excise duty, which is 144 million or 11% less than the annual revenue plan. The SRS points out that excise tax revenues in 2020 have exceeded the amount of revenues for the respective period of 2019 in only six months, and it has also failed to achieve the revenue plan for 2020 in any month. The SRS also explains this fact with the restrictions on recreation, entertainment, tourism and socialization introduced to limit the spread of Covid-19, which significantly affected the consumption of several types of excise goods.

Labor tax revenue in 2020 was about half (53.9%) of the total revenue. Compared to 2019, they have decreased by 138 million euros, including personal income tax revenues that have decreased by 129.3 million euros or 6.6%, while state social insurance mandatory contributions - by 8.66 million euros or 0.2%.

"The decrease in revenue is not only due to the introduction of the state of emergency in spring 2020 but also to the restrictions maintained after the lifting of the state of emergency in the summer period, as well as the introduction of the second state of emergency from 9 November 2020, when significant economic measures were introduced,” explains the SRS.

However, if the revenue plan of the state social insurance mandatory contributions has been fulfilled by 96.1%, then the personal income tax revenue, despite the decrease in revenue compared to 2019, has ensured the fulfillment of the revenue plan in the amount of 103.4%. In 2020, 179 million euros were repaid from personal income tax, which is 8.8% more than in 2019.

However, revenues from fines and sanctions were met and exceeded last year. The state had planned to collect 31.96 million euros, but actually the state budget was supplemented by 37.77 million euros. This is the largest fine amount ever collected in the state budget. In 2018 and 2019, the revenue from this was approximately 32 million euros, in 2017 - 35 million euros.