Krišjānis Kariņš's government "gifted" $750 million in export earnings to Lithuania and Slovakia

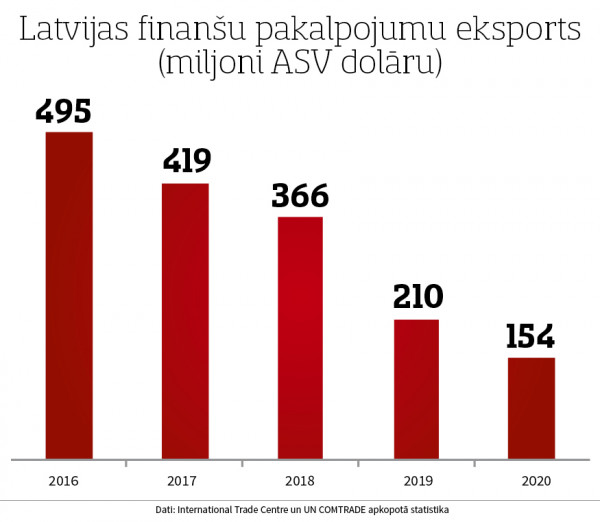

According to the statistics compiled by the International Trade Center, the Latvian commercial banking system was “put in order” by practically abandoning the export of financial services. In the period from 2017 to 2020, Latvia is the European leader in terms of the relative volume by which the export of financial services decreased. Latvia is in the first place in Europe in terms of the decline in financial services. In 2017, Latvia's exports of financial services amounted to almost half a billion (495 million) US dollars. In 2020, Latvia's exports of financial services were only 154 million dollars.

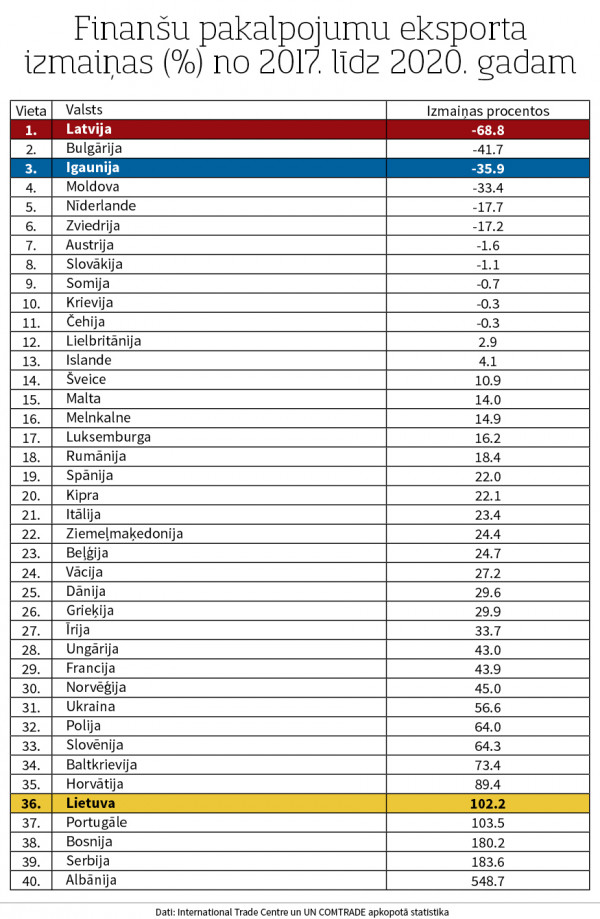

Between 2017 and 2020, the volume of Latvian financial services exports decreased more than three times or by 68.8%. No other European country saw such a large decline in financial services exports at this time. During this period, the decline in Bulgarian financial services exports was 41%, Estonia 35.9%, Moldova 33.4%, the Netherlands 17.7%, and Sweden 17.2%. Five European countries saw a small decline of less than 2%, while all other European countries saw an increase in financial services exports. It doubled for Portugal and Lithuania, and increased by more than 60% for Slovenia and Poland.

The decrease in Latvia's financial service exports was due to the fact that during this time Latvia introduced large-scale burdens on the banking system, which were supposedly aimed to stop criminals who used bank payments to launder money, but actually made it impossible to conduct financial services export business in Latvia.

As a result, in 2020, the income of financial service export in Latvia was only 81.7 dollars per capita. By comparison, in 2020, Luxembourg's per capita export earnings in financial services were more than 100,000 US dollars, Malta's - 8,426 dollars, Cyprus's - 5,126, Ireland's - 3,983, Switzerland's - 2,523, and the United Kingdom's - 1,157 dollars per capita. After the financial sector was “put in order”, the export of financial services is no longer a significant specialization for Latvia in the international division of labor.

In 2020, even the export income of Latvian rapeseed growers was higher than the export income of all Latvian commercial banks' financial services combined.

Given that at a time when Latvia (and partly also Estonia) saw a significant decline in financial services exports, financial services exports synchronously grew in Lithuania and Slovakia (both eurozone countries), it is likely that many international companies relocated bank payments from Latvia to Lithuania, Slovakia and other countries due to Latvia's burdens. In essence, Kariņš's government ensured an increase in the welfare of the population of the countries that took over the customer service for clients that left Latvian commercial banks. It can be estimated that over the last three years, Latvia's GDP would have been 750 million dollars higher without such overarching banking burdens. The Latvian economy did not directly feel such a large decline in financial services exports, since from 2017 to 2020 revenues from exports of goods and services increased significantly in several other sectors (wheat and rapeseed growing, construction, etc.) and generally offset losses caused by both pandemic and the collapse of the financial services export industry.

*****

Be the first to read interesting news from Latvia and the world by joining our Telegram and Signal channels.